Passion to Profit- Turning Play into Pay

Your journey from hobbyist to entrepreneur can take your passion and turn it into profit.

Many successful businesses have been born out of someone’s hobby or passion. Sometimes it happens accidentally, where someone sees your work or something you have made, and they want to buy it. Turning your passion into profit is worth looking into, if you find you’re ready to turn play into pay.

Other times you might realize that you really enjoy what you are doing, and you think there is a market for it. Perhaps you are unhappy working for someone else or you want to make a little extra income.

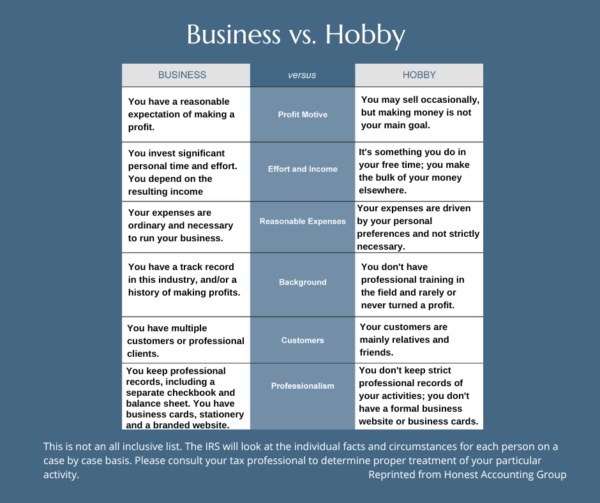

This chart illustrates where the differences lie. It was created by an accounting firm as a way to check your status from a tax standpoint, but I look at it as a way to check your mindset.

It centers around 6 important areas. Let’s look at them:

-

Profit Motive? Is there a reasonable expectation that what you want to do can make a profit or is money not really the driving force? If you are an entrepreneur, profit is going to be a motivator for you. You will look at what you are making or offering and make sure there is a healthy profit margin in there. You’ll take the time to consider all the costs involved and price your product or service accordingly.

-

Effort and Income. You go into this knowing you will invest significant time and effort, but you are expecting it to generate income. It’s no secret that starting and running a business involves a lot of time and effort. If this is more of a side hustle you might do it in your free time and your income will come from somewhere else.

-

Reasonable Expenses. Are your expenses more in line with what is normal or are they more likely based on spending what you want, when you want. Understanding and managing your expenses is critical to a successful business.

-

Background. You have a track record in this industry and/or a history of making a profit. Experience in the field you want to start your business in can make all the difference in the success of your business. If you are in need of funding then experience is something that lenders look for.

-

Clients. You have a wide variety of clients vs. your clients mainly being friends and relatives. This really speaks to the marketability of what you want to do. We can usually get friends and family to buy what we have to offer. The real test comes when we see if there is a market for what we want to do outside our inner circle.

-

Professionalism. Your records and financials are professional. You are using accounting software or the services of a bookkeeper or CPA. You have professional marketing materials, business cards and a branded website. You understand the importance of how you present yourself to the public. The hobbyist is the opposite. You might not even keep records of income and expenses. Your record keeping, your presentation to the public might look amateur or even non-existent.

It’s important to examine your motives and mindset if your business idea is an outgrowth of your hobby.

If you have decided to move forward with turning your Passion to Profit,

here are a few steps to get you started.

-

Market research.

Conduct thorough market research to understand the demand for your hobby-based business. Identify your target audience, competitors, and potential challenges in the market.

-

Start-Up Costs.

Create a list of all the costs involved in turning this into a business. Investigate what your licenses and permits will cost, insurance, marketing, legal and accounting fees and more. Use this checklist to help you research what those costs will look like for you.

-

Name your business.

Come up with a name that will tell others what you do or offer. Make sure it is available as a business name and domain name. Don’t rush this. The name of your business is important, and you don’t want to have to change it later on because someone else has that name or no one understands what you do.

-

Determine your legal entity.

Will you be a sole proprietor, and LLC, and S or C-corp. Research to find which one works best for your business from both a risk and a tax standpoint.

5. Create a Marketing Plan. Build a website- even a simple website. Everyone needs a website these days. You must be searchable. We know people check us out online before they ever contact us directly. Determine which social media platforms are the best way to reach your target market and set those up. Use these to share what your business has to offer, engage with your followers and grow your audience.

Create a timeline, with deadlines, for all the steps to be taken.

Hold yourself accountable to pushing through even when things get tough.

Check out what the IRS has to say as well.

Earning side income: Is it a hobby or a business? | Internal Revenue Service (irs.gov)

Hobby or business: here’s what to know about that side hustle | Internal Revenue Service (irs.gov)

If you need help with all or part of going from hobbyist to entrepreneur, we are here to help.

Reach out to see if we would be a good fit for you.

rhondaloweconsulting@gmail.com